To know the compliance with GST one should know whether a person is registered under GST or not. This is the most fundamental requirement for identification of tax payers ensuring tax compliance in the economy. This becomes more fundamental because under indirect tax regime, without registration, a person can neither collect tax from his customers nor claim any credit of tax paid by him.

Registration legally recognizes a person as supplier of goods or services or both and legally authorizes him to collect taxes from his customers and pass on the credit of the taxes paid on the goods or services supplied to the purchasers/recipients. In other words he can claim the Input tax credit for the taxes paid and can pass on that credit to the recipient of goods or services.

Under GST regime Supplier is required to obtain State-wise GST registration. There is no concept of a centralized registration under GST like the erstwhile service tax regime. A supplier has to obtain registration in every State/UT from where he makes a taxable supply provided his aggregate turnover exceeds a specified threshold limit. Thus, he is not required to obtain registration from a State/UT from where he makes a non-taxable supply.

Since registration in GST is PAN based, once a supplier is liable to register, he has to obtain registration in each of the States/UTs in which he operates under the same PAN. Further, he is normally required to obtain single registration in a State/UT. However, where he has multiple places of business in a State/UT, he has the option either to get a single registration for said State/UT [wherein it can declare one place as principal place of business (PPoB) and other branches as additional place(s) of business (APoB)] or to get separate registrations for each place of business in such State/UT.

Chapter VI - Registration [Sections 22 to 30] of the CGST Act and Chapter III – Registration [Rules 8 to 26] of the CGST Rules contain the provisions relating to registration.

Relevant sections Under GST: Chapter VI – Registration of the CGST Act:

Section 22: Persons liable for registration:

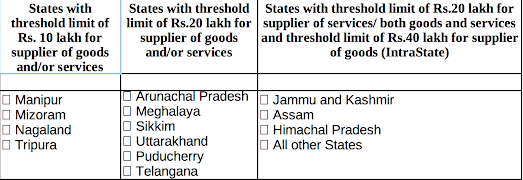

Sub-section (1): Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States(Manipur, Mizoram, Nagaland, Tripura, Jammu and Kashmir, Assam, Himachal Pradesh, Arunachal Pradesh, Meghalaya, Sikkim, Uttarakhand) from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees.

Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees.

Provided further that the Government may, at the request of a special category State and on the recommendations of the Council, enhance the aggregate turnover referred to in the first proviso from ten lakh rupees to such amount, not exceeding twenty lakh rupees and subject to such conditions and limitations, as may be so notified.

Provided also that the Government may, at the request of a State and on the recommendations of the Council, enhance the aggregate turnover from twenty lakh rupees to such amount not exceeding forty lakh rupees in case of supplier who is engaged exclusively in the supply of goods, subject to such conditions and limitations, as may be notified.

Explanation––For the purposes of this sub-section, a person shall be considered to be engaged exclusively in the supply of goods even if he is engaged in exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount.

Sub-section (2): Every person who, on the day immediately preceding the appointed day, is registered or holds a license under an existing law, shall be liable to be registered under this Act with effect from the appointed day.

Sub-section (3): Where a business carried on by a taxable person registered under this Act is transferred, whether on account of succession or otherwise, to another person as a going concern, the transferee or the successor, as the case may be, shall be liable to be registered with effect from the date of such transfer or succession.

Sub-section (4): Notwithstanding anything contained in sub-sections (1) and (3), in a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, de-merger of two or more companies pursuant to an order of a High Court, Tribunal or otherwise, the transferee shall be liable to be registered, with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court or Tribunal.

Explanation––For the purposes of this section, ––

- the expression “aggregate turnover” shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals

- the supply of goods, after completion of job work, by a registered job worker shall be treated as the supply of goods by the principal referred to in section 143, and the value of such goods shall not be included in the aggregate turnover of the registered job worker

- the expression “special category States” shall mean the States as specified in sub-clause (g) of clause (4) of article 279A of the Constitution except the State of Jammu and Kashmir and States of Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand.

- Individuals registration under pre GST regime i.e registered under Excise, VAT, Service Tax etc.

- Businesses that meet the threshold criteria. i.e above 40L or 20L or 10L as the case may be.

- Casual taxable person/Non-resident taxable person.

- Persons paying taxes under Reverse Charge Mechanisms(RCM).

- Agents of Supplier and Input service distributor.

- A person who supplies via an e-commerce aggregator.

- E-commerce aggregator

- Person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person.

- Tax payers gets GST Reg. certificate in form GST REG-06 wherein valid GST identification in Mentioned.

- Tax payer is eligible for ITC

- Can raise tax invoices

- Has to file GST returns.

No comments:

Post a Comment